Uncovering Hidden 401(k) Fees: What Every Plan Sponsor Should Know

June 26, 2025

401(k) plans are designed to help employees secure their financial future—but hidden fees can quietly chip away at an individual’s retirement savings and make a significant impact over a long period of time. As a plan sponsor, it’s your responsibility to ensure that fees are transparent, both for fiduciary compliance and to protect your employees’ financial well-being. Understanding these fees and where they tend to be hidden is essential to making prudent decisions.

Why Hidden Fees Matter

For plan sponsors, transparency isn’t just best practice—it’s a legal requirement. A lack of understanding of the true cost of 401(k) service provider fees can lead to compliance risks, potential lawsuits, and diminished employee trust. For participants, these fees may seem small, but over decades, they can erode retirement savings and diminish the effect of compound growth in a portfolio.

Common Ways Fees Are Hidden or Misunderstood

Revenue Sharing: Fees that are collected by 401k service providers and then subsequently shared with other service providers.

- Example #1: Investment providers sometimes offer funds or share classes with inflated investment fees that allow for a portion of those fees to be shared with the record keeper to cover their needed revenue. Numerous times we have spoken with plan sponsors that believe that their record keeping services are “free” because there isn’t an invoice to be paid or a separate line item on their P&L. This is simply not accurate. Record keepers do not work for free! We don’t expect them to be the cheapest or lowest cost, but we do feel that it is important for plan sponsors to know if revenue sharing exists in their 401(k) and how to evaluate each individual service provider.

- Example #2: Record keepers will often partner with TPA’s to help build trust and continuity with their common clients. Some of these recordkeeper/TPA partnerships involve the record keeper sharing a portion of their fee with TPA’s. You can see how difficult this can be when it comes time to benchmark your record keeper and TPA. Without understanding the true cost, benchmarking service provider fees can be misleading and ineffective.

Asset-Based Fees: Fees that are charged using a percentage of total plan assets have become the industry standard. As a plan’s total assets increase, it can (not always) become more profitable for service providers that charge an asset-based fee. As you may suspect, service providers will rarely volunteer a fee concession even if the plan becomes excessively profitable and oftentimes it goes unnoticed because it appears that their fees have not changed (e.g. 0.25% flat fee). This is why benchmarking fees annually and conducting the occasional RFP can help keep your asset-based fees in line with industry averages.

Post-Plan Services: Managed account services are sometimes included in 401(k) plans with the intention of providing support to employees that are approaching retirement or at retirement. While potentially beneficial for some participants who actively engage in the service, these services typically carry higher fees for participants and can severely impact investment returns. Our observation is that participants who enroll in managed accounts often don’t fully grasp the added costs and receive little value due to a lack of engagement.

Other Less Common Ways Fees Are Hidden or Misunderstood

These less common fees often exist within investment products and aren’t required to be fully disclosed:

- Managed Accounts – Extra fees tied to outsourced investment management that are often used to subsize record keeping fees. This creates a situation where participants using managed accounts effectively pay more, leading to lower apparent costs for those who don’t.

- Fixed Accounts – Restrictions on withdrawals and lower-than-expected yields.

- Fixed Accounts (in Target Date Funds) – Embedded fees reducing participant returns.

- Structured Products in Target Date Funds – Additional costs baked into asset allocation.Proprietary Investment Options – Fees from in-house fund offerings benefiting the provider.

What Plan Sponsors Can Do

- Request Full Fee Disclosures (408b2 & 404c5): Require itemized fee breakdowns and challenge excessive costs.

- Partner with Transparent Advisors: Partner with advisors who will (1) help you weed out the true cost of your service providers, (2) perform formal RFP’s with top-tier service providers, (3) help you feel confident you are paying reasonable fees and focusing on value.

- Educate Employees: Provide clear resources so participants understand how fees impact their savings.

For plan sponsors, hidden fees can mean falling short of fiduciary responsibilities or overpaying for services. For participants, hidden fees can translate into thousands lost in potential retirement savings. Is your plan optimized for cost efficiency? Start asking the right questions and feel confident about your retirement plan fees today.

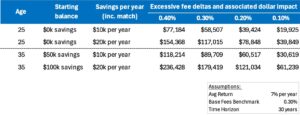

The Cost of Hidden Fees: A Hypothetical Look

To help visualize how excessive fees may affect an individual over a long period of time (30 years), please reference the Exhibit’s A and B below to view different participant scenarios.

Exhibit A:

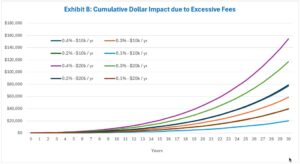

Exhibit B:

Exhibit B – 401k Excessive Fees

Note: Chart above only shows scenario where employee starts with $0k account balance. Same assumptions as Exhibit A.